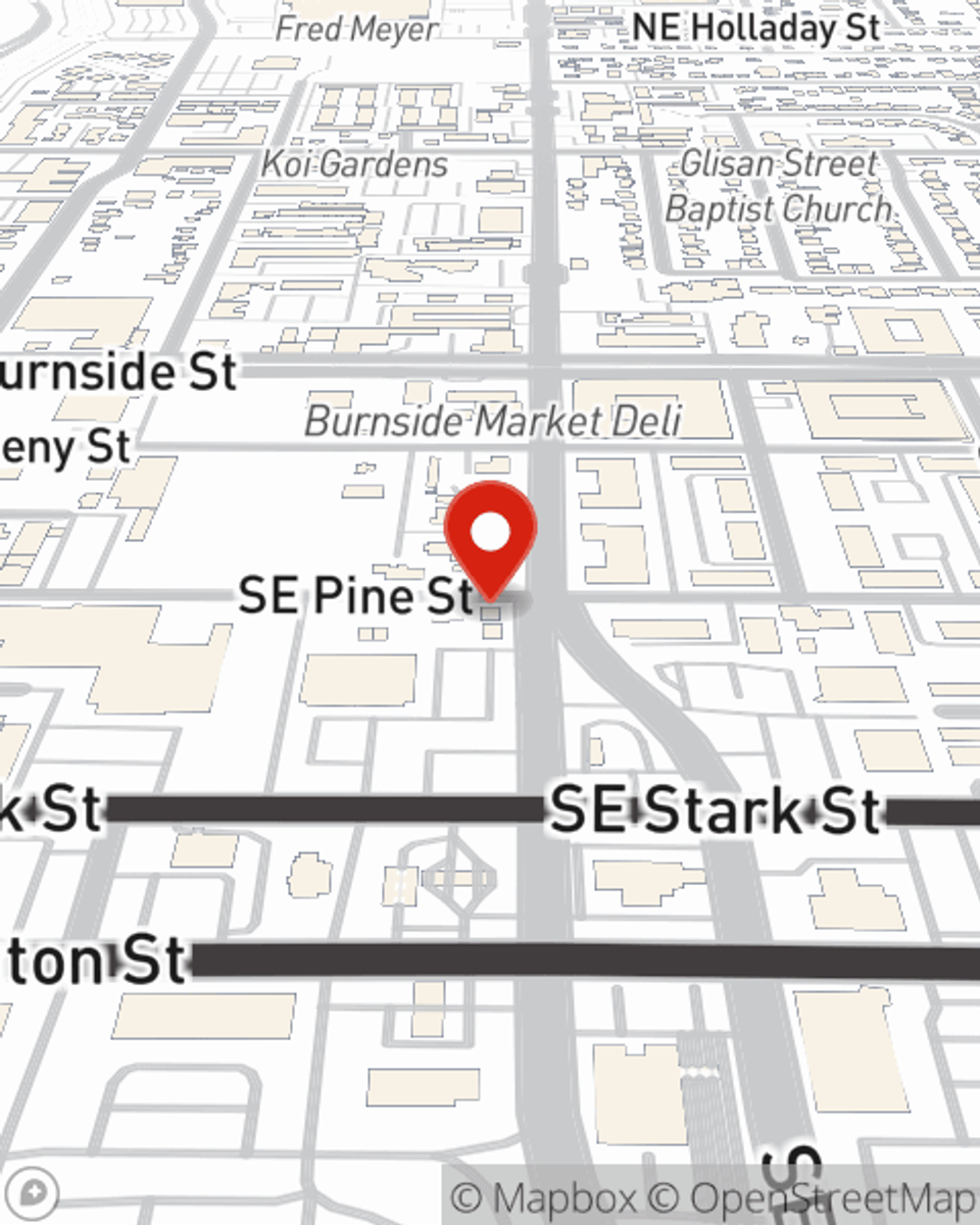

Business Insurance in and around Portland

Calling all small business owners of Portland!

Cover all the bases for your small business

- Portland

- Oregon

- Gresham

- Troutdale

- Happy Valley

- Southeast Portland

- Northeast Portland

- Northwest Portland

- Southwest Portland

- Oregon City

- Milwaukie

- Salem

- Eugene

- Springfield

- Washington

- Vancouver

- Washougal

- Camas

State Farm Understands Small Businesses.

Whether you own a a hearing aid store, a veterinarian, or a home improvement store, State Farm has small business insurance that can help. That way, amid all the different options and moving pieces, you can focus on your next steps.

Calling all small business owners of Portland!

Cover all the bases for your small business

Keep Your Business Secure

Your small business is unique and faces specific challenges. Whether you are growing a cosmetic store or a dry cleaner, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your product, you may need more than just business property insurance. State Farm Agent Spencer Hall can help with business continuity plans as well as mobile property insurance.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Spencer Hall's office today to discover your options and get started!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Spencer Hall

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.